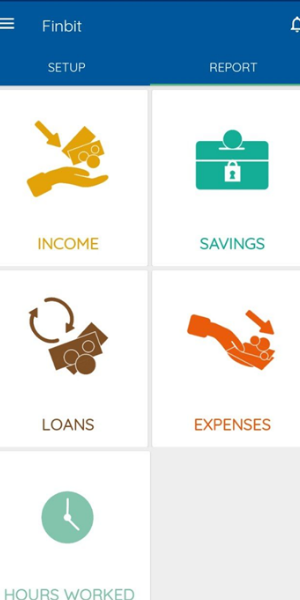

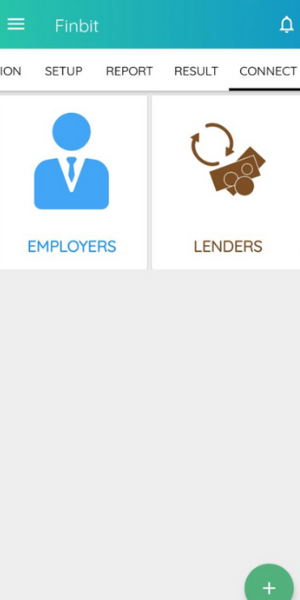

FINBIT is a technology system with an android app and data portal for data collection developed by L-IFT Research Company. It is a user friendly app that is created in order to track daily financial activities, hence by using FINBIT, we can record data of every transaction and feature of incomes, expenditures, savings, loans, hours worked, check all business aspects such as employees, their pay and their hours worked, their clients, any innovation implemented, see their reported data presented in various table and graph forms presenting their financial activities in an attractive manner (it will help us to perform an app based data collection).

FINBIT can assess what your target-group appreciates, type of improvements needed on the services, and whether they have gathered new knowledge based on the services provided. It can track whether clients’ lives are improving or not when the programme is implemented and analyze the change afterwards; it can also check how the implementation of a program is progressing at beneficiary or target group level.

Users can also approach banks or MFIs for loans based on their reported financial transactions. It will also link employees and employers by presenting the data in order to support the job applications.

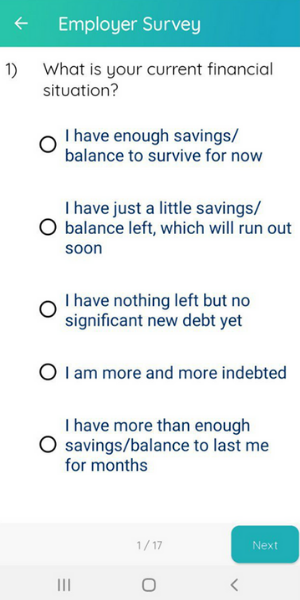

A client of FINBIT will be able to SETUP his/her Income sources, Saving Accounts and Loan; REPORT income, hours worked, expenses, savings/withdrawal and loan; see analyzed RESULTS in the form of graphs, tables and written reports and will be able to participate in surveys.

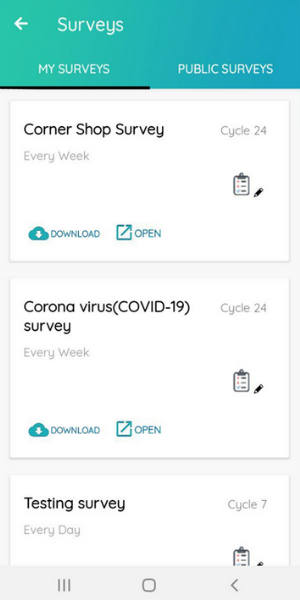

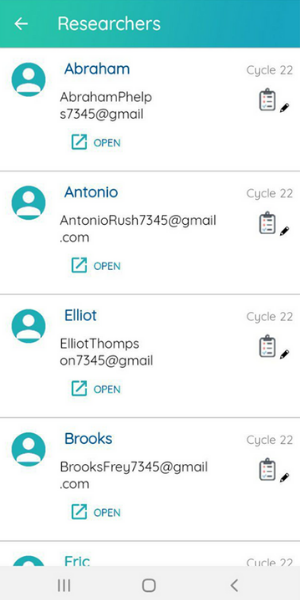

In addition, FINBIT also allows us to track non-financial data. Non-financial surveys can be designed either as recurring (surveys that have similar questions appearing in a specific period set by the designer; special questions can be added in recurring surveys during any cycle or one-off survey (surveys that are asked only once). The surveys can be conducted either by the respondents themselves via self-reporting or by researchers assigned to the respondents. There are also two types of surveys; public survey in which any user can participate in the survey based on demographics e.g. all female users, all users aged 30 or over and living in Senegal and Private Survey in which only assigned users who belong to respondents from a specific organization can participate in the survey.

FINBIT has a web portal where it is possible to visualize reports in the form of graphs and tables, manage income, expenses, savings and loan types, track the data of individual user, design and organize surveys and see analyzed results in the form of graphs and table. It enables to track the financial data progress of all users in the study through the raw data and it enables to also export the data using different options like specifying a date range, include Respondent IDs and demographics filter. It makes both aggregate and individual data accessible. It also makes filtered and segmented results of certain groups possible and makes credit analysis for individual users to make loan worthiness decisions. It makes it simple for lenders have access of financial data of individual users who apply for a loan. It has a notification feature which to help in reminding the report process.

Both financial and non-financial data can be verified individually (can track the financial data progress of a single user in the study through a given period of time) or collectively (can track the financial data progress of all users in the study through a given period of time).

This bird’s eye view of the FINBIT app serves as an introductory note and is intended to create a curiosity so that anyone who is interested can explore further and benefit from its services.