Education loans

During the course of the financial diaries project, we discussed many different types of loans with the respondents, who were all clients of either BRAC or MFIL. We approached the topic from different angles.

Sometimes we discussed about their financial challenges first and in a participatory way found out which type of loans might support the respondents to solve these challenges. In other interviews we explained about different types of loan options, available around the world, and asked the respondents their opinions.

In October 2018 (around 11 months after the very first interviews took place) we asked a host of questions on school loans. The respondents were very keen on getting loans for education, but their suggestions for duration and repayment schedules show quite a classic loan picture, with hardly any variation on the current loan types.

Overall, at least seven out of ten respondents (71 percent) wanted an education loan. They primarily wanted secondary school loans (63 percent of those wanting education loans). Most of the respondents wanted these education loans to be for the duration of a year, with a monthly repayment schedule and interest rate of 1 percent per month. The loan size they would require varied quite a bit with 450,000 kyat (about 300 USD) being the median amount and one-third needing 550,000 kyat (about 366.67 USD) or more for secondary school loan.

All in all, this is exactly the loan design that they already receive from BRAC and MFIL on business and income generation loans, with the small adjustment of a monthly repayment instead of a two-weekly repayment schedule.

Emergency loans

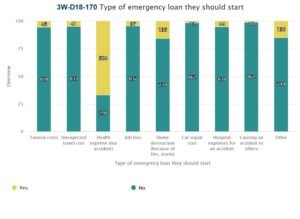

The respondents overwhelmingly wanted their MFI to start offering emergency loans to cover health costs. Two-thirds of the respondents felt this was a loan type they needed (67 percent). The only other type of emergency loan that got some traction was a loan for ‘home destruction’, which was mentioned by 16 percent of the respondents.

For health cost loans, the median desired loan size was 500,000 kyat (about 333.33 USD) and only 14 percent anticipated to need less than 300,000 kyat (about 200 USD). Otherwise, again, the loan features the respondents proposed were an exact copy of the current loan designs: 1 percent interest rate, duration of 12 months, repayment every 4 weeks (instead of the current system of bi-weekly repayment).

Insurance

Regarding insurance, quite a few of the respondents were interested in such services. They were primarily requesting life insurance (two-thirds of the respondents preferred that service), while health insurance was the second preference, selected by 26 percent of the respondents. If the insurance would pay out hundred fold the premium, a substantial portion of the respondents (38 percent) would be interested in paying just 1000 kyat (about 0.67 USD) as premium, which would result in 100,000 kyat (about 66.67 USD) payment if the insured event would pass. Just short of a quarter (23 percent) would be willing to pay 5,000 kyat (about 3.33 USD) and thereby receive 500,000 kyat (about 333.33 USD) payment if the insured event happens. In short, interest in insurance is quite high but the amounts women entrepreneurs are willing to pay as premium is quite low.

Savings services

Many respondents were interested in receiving savings services from their current MFI. Half of these (51 percent) just wanted a ‘savings deposit account’. The second most attractive option was ‘future plus’ (saving for a specific target) which was selected by 23 percent.

Remarkably, these micro-business women primarily preferred their savings to be accessible and they were prepared to forego high interest payments. Only 18 percent preferred to have higher interest in exchange for less access to the deposit. This is strongly different from non entrepreneurs in other countries, where the majority prefer savings accounts where they cannot easily withdraw, since they like to have help in disciplining themselves.

Maybe it is a feature of entrepreneurs that they want to keep access to their savings while other people want the savings service to help them discipline and not touch the money for some time. To establish whether this is a Myanmar feature or a feature of entrepreneurs, we would need data from non-entrepreneurs in Myanmar and data from micro-entrepreneurs in other countries.

What do these findings on product development mean for the Financial Service Providers?

First of all, the important learning is that when asking people what services they need, they will usually simply mention the services they already are used to. It is very hard for people to imagine new products themselves. Even when they are asked about concrete alternative products, people are not likely to be enthusiastic simply due to the product being unknown. To really introduce new products, the users need to go through a process of familiarizing and testing the new products, and given a chance to taste the products. Financial diaries offer an ideal setting for this.

Secondly, from our discussions with a large number of women micro entrepreneurs we can conclude that there is most interest in:

- Secondary school education loans

- Health emergency loans

- Life insurance

- Accessible deposit accounts

What Women Want (3W) – Access the diaries data portal at my.l-ift.com