Financial Diaries data provides valuable insights into the spending patterns and financial behavior of business owners, individuals, and households. By analyzing the data collected from financial diaries, researchers can gain a deeper understanding of how people make decisions regarding their finances. They can explore various aspects, such as the types of financial instruments used, debt levels, credit repayment patterns, and the use of formal or informal financial services.

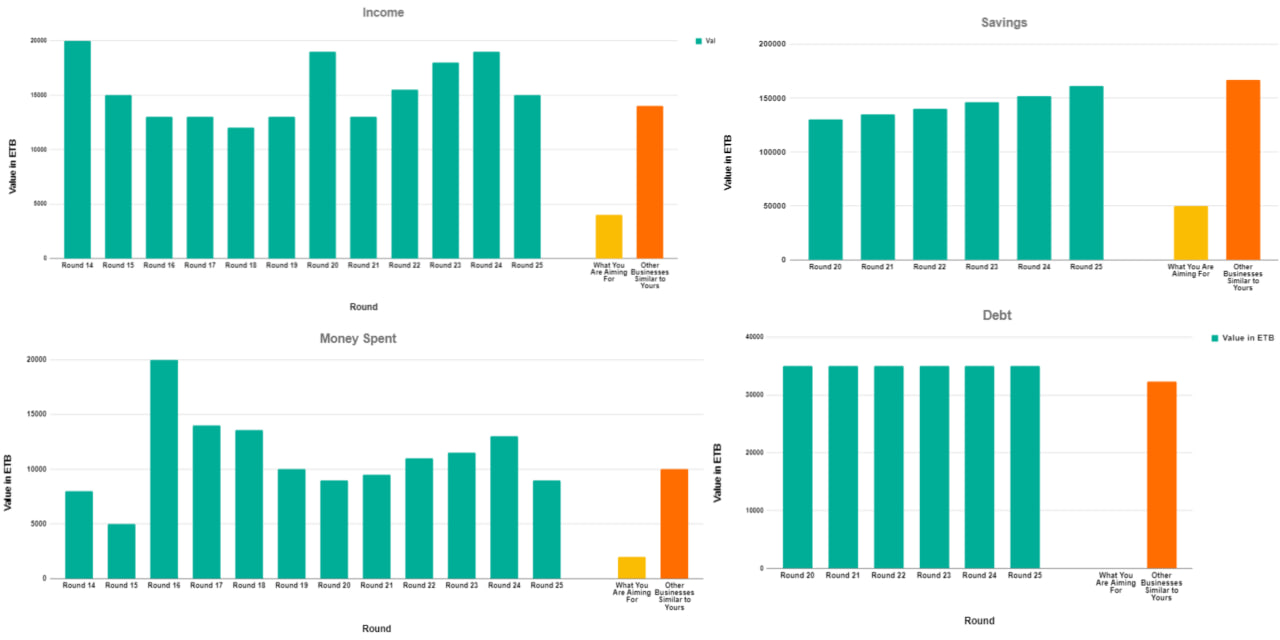

Just two months ago, L-IFT, in collaboration with the Financial Access Initiative of New York University and Career-path, completed a research project we named ‘Financial Diaries of Female Entrepreneurs in Uganda’ (RFDF). This project was funded primarily by the MasterCard Foundation. The study consisted of a Randomized Controlled Trial (RCT) in which about 600 female retail entrepreneurs participated. In the study, participants were randomly assigned to three study groups, of which two groups participated in reporting to FINBIT technology their financial diaries. For the diaries’ groups, the treatment was reporting all their financial transactions to a well-trained field researcher (FRs) who inserted the data for each respondent in the respondent’s FINBIT account. One of the treatment groups (T2) received every two weeks a printed report with graphs about their key business data as recorded on the technology. Effectively, respondents in this treatment group had the chance to check the status of their business from the reports every two weeks. The reports included graphs on their income, expenses, loans, and savings and showed how the study participants’ data compared to their goals for the indicator and the other study participants, in a comprehensive, visualized manner. The graphs shown to the respondents looked similar to the following graphs (for data privacy reasons we cannot show any of the real reports).

As per the observations we got from our field researchers who delivered the printed reports for a year (26 rounds) and assisted this group of participants in comprehending the reports during their visits, almost all of the respondents were grateful for getting the reports. The respondents were happy to see the reports because they depict what happened in their business in a detailed but concise way, in three pages. On top of this, they can compare the performance of their business continuously. We asked our FRs to write about their experience of discussing the reports with the business owners and here you can read what some of them expressed:

The respondent[1] is grateful for the reports she receives every two weeks. She says that reports have helped her to understand how her business income and expenditures keep on varying. She says that she didn’t know that such a small business could make such a lot of income in the two weeks. She is happy that L-IFT came up with the idea of summing up their income and expenses for them. She is always eager to know what happened in the last two weeks and always waiting for the report.

Another respondent had so much interest in the savings part. Each time I give the report, she tells me to first go to the savings part. She is a respondent who tries to save money every day, no matter how small the amount is, even if it’s 1,000 UGX. I remember when she withdrew more savings than she deposited, she told me to never bring back the report until her savings were corrected. When they were corrected, she was so happy and appreciative. She likes to see the blue bar that indicates that savings are increasing’ (Gashumba Aisha, a Field Researcher at L-IFT).

As indicated by the FR, many of the respondents explained the importance of the reports to better understand how they are running their business, including how much they are getting from which income sources, on which type of expense they are spending a lot of money, how their savings are progressing, about their loans (given/taken) records, and whether they are getting profits or not. The following explanation from one of the FRs can be taken as one of the typical experiences that the respondents had in understanding how their business is doing in getting the reports driven from the data recorded on FINBIT.

One of my respondents always insisted before we started any interview seeing her report and seeing whether her bar of sales had increased and also whether the bar of expenses had reduced. I have tried to explain to her every time that it’s not bad for the expenses bar to increase because it might be increasing due to an increase in stock purchases, she always forgets, but I know she will get used to it. She says this has led her to stop buying water for drinking at work and, coming with her already-boiled water from home. She also decided to reduce other unnecessary expenses like breakfast and black tea every morning. Instead, she comes with her tea from home. She now uses this money for transport on Sunday to go and check on her children in the village. She also says that the report has made her discover that she always gets profits, and she makes a lot of sales. However, she also has a lot of unavoidable expenses like losses. She has the habit of always saving a certain amount no matter the circumstance, but she previously couldn’t tell if she was saving from her profit or if she was saving while making a net loss. (Nkwasibwe Edward, a Field Researcher at L-IFT).

Not only were they trying to understand what was going on in their businesses, but some of the respondents eventually started to predict the contents of the next round of reports as they got used to them. A note from one of the FRs has explained this as follows:

One of my respondents always predicts her reports before I even hand it to her. She is aware of every performance especially, via sales every fortnight. On approaching her, she will proclaim “Teacher (as they always refer to us), I know this time the sales bar will be down since sales weren’t as good as the last time.” She instead interprets the report for herself and requests to be corrected if otherwise’ (Resty Nakalyango, a Field Researcher at L-IFT).

On top of this, some respondents took lessons about the benefits of bookkeeping through the experience of getting reports from the project. One of the FRs explained this as follows:

One of my respondents herself designed her recording book after she received the third round report and appreciated that the reports she received reflected and interpreted her business properly. She strongly relies on and is always eager to look at the bars. To this particular respondent, the reports now act as her official business reports after the daily keeping of records, and she keeps saying she never knew she needed records till this project’ (Lilian Koli, a Field Researcher at L-IFT).

The treatment T2 group of the RFDF project where their business transactions were recorded on FINBIT and they got summarised progress reports appear to be useful for the diarists. Our FRs have witnessed that the reports have helped respondents to make informed decisions about their businesses. The following are some of the experiences that our FRs shared with the research team as they observed the respondents making well-informed decisions. The decisions include measures taken while running a business like this one:

The reports have helped one of my respondents to manage and grow her business. They have also helped her to know that she needed to stop giving out her goods on credit because she has lost a lot of capital in giving out loans because debtors didn’t pay her back. She also learned that she should stop asking for many loans because she could not save while servicing the loans at the same time (Kamoga Doreen, a field Researcher at L-IFT).

Others have made big decisions that might be difficult for a business owner to make without the genuine evidence in the reports from diary data. One of the respondents has decided to change the types of goods she is retailing and the other has decided to focus on another income source rather than spending her time with a business that has insufficient returns. The notes from FRs on these two experiences are stated as follows:

For one of my respondents, the reports are very important because they show her the income, expenditure, and savings of her business. That’s how she understood that she wasn’t making good income from her boutique business, and she has finally decided to change her business to a phone accessory retailing shop’ (Kamoga Doreen).

‘One of my respondents says, “There is nothing significant I am doing here. Look at the sales. That’s why I have decided to go back and dig at the farm. My daughter will run this shop, going forward. The shop can only bring in very little money and cannot even pay rent. If I increase the stock, people at times don’t buy. So what am I doing here exactly? But this situation is not affecting me alone. Look at my neighbor who sells Chapati. He used to make 10 packets of flour each day; now he says he makes 5 packets” (Dianah Kyebuzibwa, a Field Researcher at L-IFT).

From all the experiences we had with the study participants, we can conclude that diary data gives each business owner some information that is useful to them, according to their focus, priorities, or goals.

^ Internally we report about respondents using an ID number. We have left out the ID number in this report to provide extra protection to the individuals.