The Small Firm Diaries Project (SFD) is a study that focuses on small businesses, under the lead of New York University. The study has been underway in Ethiopia since December 2020. The census stage, to get a pool of potential participants for the study, has been completed (SFD Blogs – L-IFT) in February. After the census was completed, the next step was to conduct the intake survey to get more information about the businesses in order to select the right mix of business firms for the diary stage, the full year of weekly interviews tracking participant firms’ business situation. The Intake survey is composed of a few questions that give sufficient information to decide whether a firm is an appropriate and willing participant for the diaries study. The Intake includes questions on the number of employees the business has; what the ownership structure looks like, whether the manager is (co) owner, how long the firm existed etc. Apart from helping in sampling, these data also allow us to determine the demographics of the firms. The Intake contains several questions to determine whether they wish to participate and are willing to share confidential and financial data in the diary interviews.

# Sampling process for the intake

The New York University team carefully reviewed all results from the census. On the basis of this, they decided which sectors could be included and which would be dropped. Sectors that fell into 3 broad categories were selected. These were:

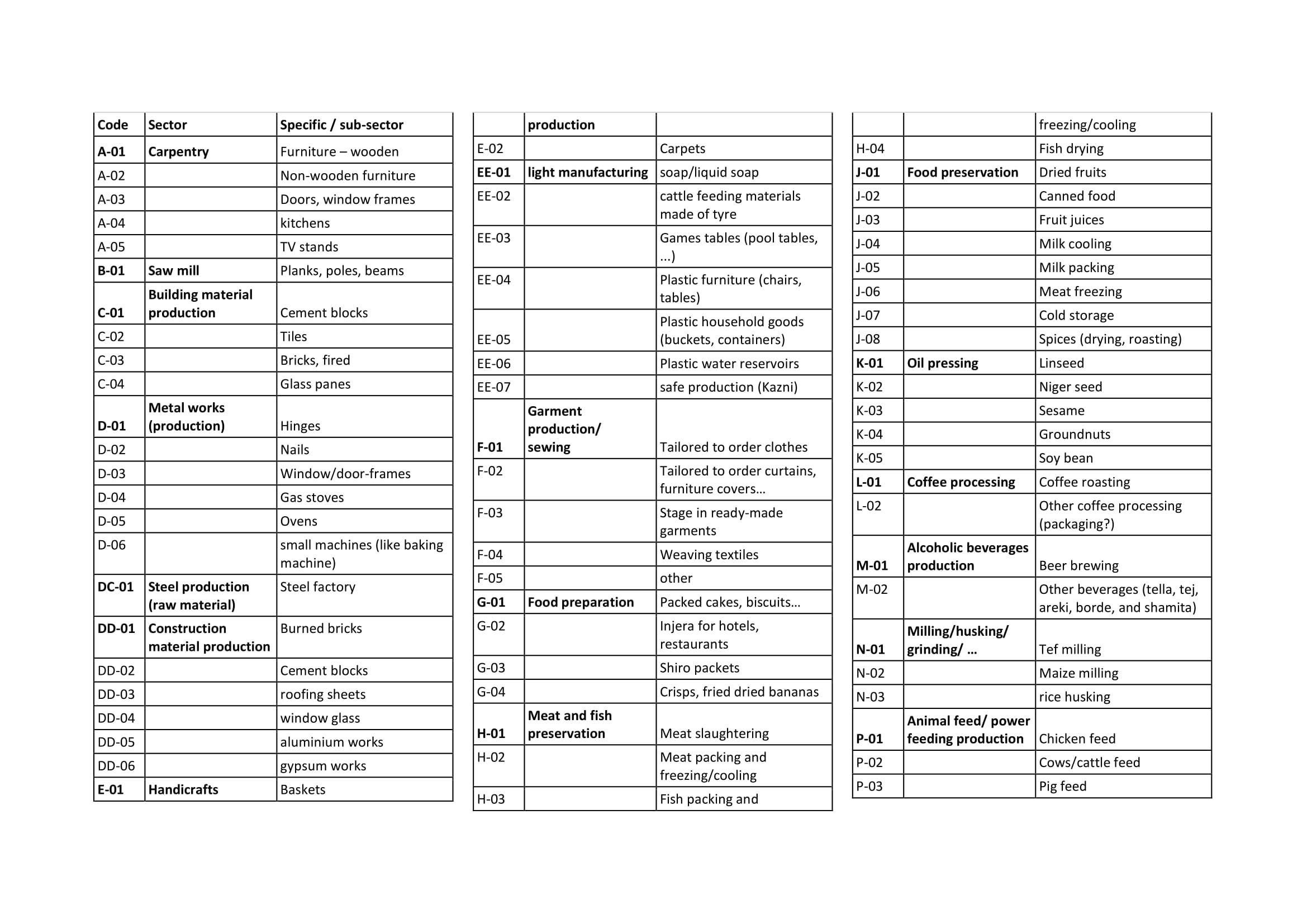

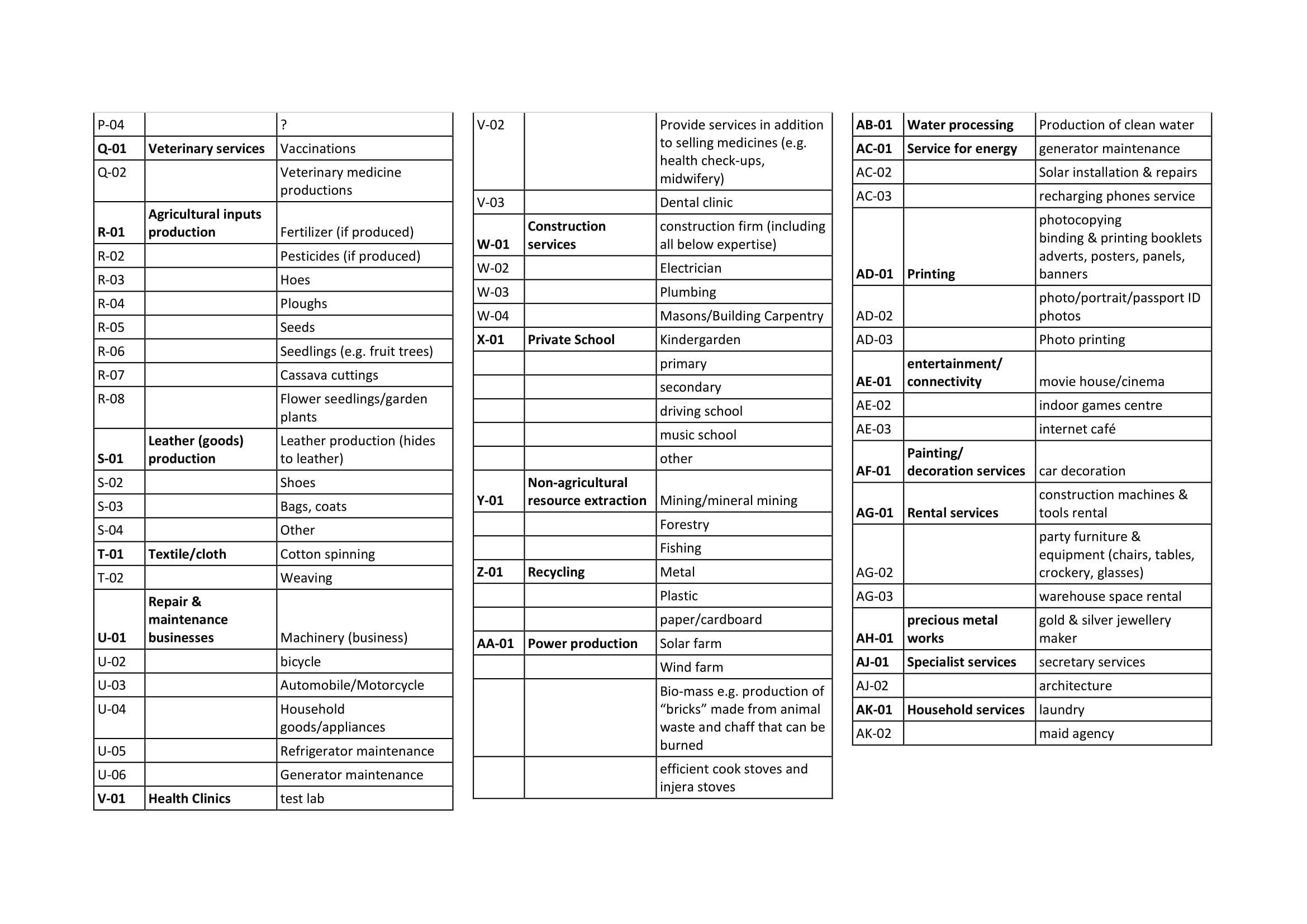

Light Manufacturing- Carpentry; Metal Works (production); Construction Material (production); handicrafts, leather (goods) production, textile (clothes), garment production (sewing)

Agri-processing- Milling/husking/grinding; Meat and Fish preservation; Food preservation; Alcoholic beverage production; Food preparation; Spices (drying, roasting)

Other- Printing, health clinics private school, repair and maintenance

Accordingly, 42 percent of the sectors in the census fell into the category of light manufacturing; 12 percent were agri-processing; 27 percent were other industry whereas 19 percent were ‘out’, rejected as sectors either because they were too close to retail (e.g. internet cafés) or too few respondents (e.g. coffee processing). (See Annex 1 for detail results per sector)

The census result was analysed carefully to select respondents for the intake survey. The first criteria used was ‘willingness to participate’ which was a sine qua non criteria (this is not a gradual indicator, but a yes/no indicator – without willingness a firm cannot be considered). Everyone who said they did not want to participate or were not sure were removed from the census. Then secondly, only those who had 2-20[1] employees were considered to be part of the sample. Some features were ‘over-sampled’ meaning that these were given priority to enter the sample, since there were relatively few of these in the census. Firms active in agri-processing were prioritized and women- /co-owned businesses were over-sampled.

[1] In the end two additional firms with 23 employees were added to the sample to ensure that there were a few truly larger firms and also to serve as a comparison. However, we only included those 20+ employee firms that were managed by the owner(s) themselves. Most of the 20+ firms were managed by a non-owner manager, which confirmed the assumption that at 20 employees firms start to hire professional managers.

Each field researcher (11 of them) were assigned respondents phase by phase. They started with 30 respondents each in a ‘first round’. The idea was that in the second round another ten would be assigned, with an over-sampling based on the composition of first round firms willing to participate. In the third and fourth round the number of additional assigned samples was based on how many diaries eligible results they had (repeatedly a quick analysis was made for the question of who was willing to participate in the diary; who had 2-20 employees and the industry to determine the additional number of respondents for the rounds). After this some people were assigned additional cases from the census while others started trying to do interviews through ‘snowballing’. The following table shows the figures for each round.

| Sample Status | Number of respondents |

| First Round | 326 |

| Second Round | 114 |

| Third Round | 96 |

| Fourth Round | 14 |

| Snowballing | 8 |

Table 1: Sample for each round

As can be seen from the table, there were 4 rounds in total. Snowballing was also tried in the intake. For snowballing the Field-Researchers enquired with eligible firms of industries and sectors which had insufficient eligible cases to introduce them to colleague firms in the same sector. For instance, the Field-Researchers revisited soap-making companies and asked them if they knew of other soap-making companies in the area that we could approach. Later on, a more general snowballing took place where Field-Researchers asked all eligible participants whether they knew of private clinics or other medical firms as well as private education companies. These snow-balled companies were not part of the census so all snow-balled firms first got the census survey and after a firm ID code was assigned, intake took place with these firms. According to the Field-Researchers snow-balling was an arduous process with very few results. This was because the majority of the owners were only familiar with businesses in their immediate vicinity so these mostly were located in the census assigned areas and these had already been covered.

# Interviewing Process of the intake

After the sampled respondents were assigned to the field researchers, they set appointments to conduct interviews with these firms. They also presented them with consent forms in local language to confirm their willingness to participate in this interview.

The field researchers successfully interviewed 379 business firms using the intake survey (out of the 550 assigned, 371 could effectively be interviewed plus eight firms through snowballing). Like the census results, the location distribution and the sector distribution are the direct result of the distribution of field researchers. Addis Ababa has five Field-Researchers, Adama three, Harar-two and Dire Dawa one. Accordingly, the intake interview took place in four locations with the highest number of interviews in Addis Ababa (47 percent); Adama/Mojo (29 percent); Harar (17 percent) and Dire Dawa (7 percent). Regarding industry: the intake interviews with results included more light manufacturing firms (54 percent); considerably less service firms (27 percent) and least agri-processing firms (19 percent). The intention was to achieve about one-third of each industry, but this proved to be quite hard.

# Challenges

The field researchers had to overcome many challenges to achieve the results. The challenges are summarized as below:

1. Finding Owners

In the census survey, field researchers were allowed to interview employees of the firm. But in the intake stage, they were required to only interview owners/managers. This proved to be quite a challenge because:

- Unavailability of owners– Owners were often not available at the location of the firm. After repeated appointments, they had to contact them via phone. But mostly, they were not responsive over the phone either, both because they would not answer their phone or did not want to discuss this over the phone. The field researcher had to visit that particular firm again and again to find the owners. Unavailability of the owners was the main cause for assigned intake firms remaining without interview results.

- Attitude of owners– they are not as welcoming as the employees; it involves a lot of discussion and some even discredited the Field-Researchers or tried to make fun of them which took a lot of patience from field researchers to get them onboard.

- Indirect refusals– These are people who do not explicitly state they do not want to participate. When researchers talk to them, they show willingness to participate and set appointments. However, they do not show up for the appointment and they reschedule again and again. This was difficult to deal with for field researchers.

- Employees presenting themselves as owners– There were cases where employees sign the consent form and commence with the interview. After a few questions, they admit that they are not really owners nor the managers which consumed time for researchers.

2. Consent Forms

- Refusals to sign-Even though the respondents gave oral consent to participate, when they were presented with the paper version to sign, there were refusals. Even if the consent form led them to believe that the research is important, they refuse to sign it before reading the section that they can withdraw from the study at any time they want. That statement might be a convincing element for them to agree but the idea of signing is scary for many respondents. According to field researchers, the consent form was viewed as a setback rather than a positive component for the research.

- Need to revisit the businesses multiple times to have the signed form-Some wanted to look it through, show their children, discuss with others etc before signing. They were offered this space. For these cases the field-researcher had to revisit, usually it required 2 to 3 days before they signed. Some field researchers had to visit them daily to get signatures. Even if they signed, they still had doubts about signing that they felt they were being forced to sign a document. They also raised concern about the similarity of the two copies of the consent form. (They had to sign two copies- one to be kept with them and one to be kept with the project). This creates additional burden for field researchers as there is also another consent form to be signed for the diaries stage.

- Respondents that were unable to read and write– There were cases in Harar where owners were not able to read and write.

- Lack of address of field researchers on the consent form-Another issue was the lack of address of field researchers on the consent form which raised concern for some of the respondents. Some field researchers had to write their phone number by hand on the form.

3. Doubts about the study

- Unspecified direct benefit for participation: Some firms were very reluctant to participate when they realized their financial transaction will be reviewed in detail every week for the next 12 months. On top of that, the researchers could not tell them a direct/tangible benefit for participation. (This was part of the script for intake – to avoid people participating for the rewards, at this stage of the study the field-researchers do not disclose whether and which reward will be available.) Some also have doubts that studies like this will bring about any real change.

- Lack of complete understanding of the research purpose: Some are extremely busy and they listen to the researchers half-heartedly and do not comprehend very well about the research. Even if they are willing to participate and sign the consent form, they may have a wrong understanding of the study. Most of them had already made assumptions about the field researchers visit. This occurs because most of the business sectors had previously received start-up training or other types of training from various NGOs as a form of assistance. Thus, this is what comes to their mind when they are approached for this study. During the diaries stage, if the difference between what they expect and what they are offered is significant, it might cause problems in the future.

- Ensuring Confidentiality-Another issue faced was about confidentiality. They needed to know how exactly their data is stored, how it is used and that it would not leak to the government or other competitors. They often said “What if you give my financial information to my rivals or other government officials? Can you show me the strategies or schemes you would use that ensures the security of the information I provide?” Some were very suspicious of the process and could not be convinced.

- Lack of faith in international organization– Some have no confidence in international organizations. When they saw the name of New York University, they wondered why and how it is associated with Ethiopia.

4. Condition of work

Some researchers were assigned a wide scope area which required long-distance walking with extremely hot weather. This was not easy to do especially considering the multiple trips they had to make to find the owners. This was also coupled with trouble they had in relocating firms assigned to them. (Due to the slow process to get permission to interview in specific neighbourhoods, field-researchers did not work in the exact same area for census as they were assigned for intake. So, for many firms field-researchers had to retrace a firm that was interviewed by someone else, using GPS coordinates, telephone numbers and firm names)

5. Inaccuracies in reporting

Overall, the information reported in the census was mostly confirmed in the intake. However, there were discrepancies in terms of the number of employees recorded in the census survey result and in the intake stage. The assumption was the discrepancy is the result of who answered the survey during the intake, assuming that if it was a non-owner, it is more likely that the information was wrong. However, the comparison analysis shows that the difference is the result of the way the question of number of employees were asked during the census and the intake. During the census, they were asked to state the number of employees both household and non-household employees or workers and there was no distinction in working full- or part-time. During the intake, they were asked to record the number for each type of employee by giving them the option of “female owner(s)”; “male owner(s)”; “female household member(s)”; “male household member(s)”; “female unpaid non-household worker(s)”; “male unpaid non-household worker(s)”; “female paid non-household worker(s)” and “male paid non-household worker(s)”. Comparing the total number of employees recorded in the census and the intake, there is a discrepancy regardless of who answered the question whether it was the owner/manager or the employee. As a result, quite a number of firms that seemed to be eligible at census, proved not to meet the minimum of two full-time non-household employees.

# Mitigation Measures

- To demonstrate to the potential participant firms what the study was exactly about and that it was under guidance of a famous university, the field-researchers showed a video where Tim Ogden (NYU team lead) briefly explained the study and gave arguments to participate. The video had subtitles in the local The video had mixed reviews. Some of the respondents had appreciated it and praised it. Some asked about the part of the video where it said “You can learn from this” and they didn’t understand what this meant. They thought it referred to training that would be given to firms. In addition, researchers had to be selective on who to show this to because it takes a few minutes and the respondents are preoccupied with their work. As the video was subtitled it also required a lot of pausing and replaying for them to read the subtitles clearly, and a few potential firm owners could not read at all. However, it was successful with a few potential respondents.

- Explaining again and again- The intake stage required a lot of perseverance, patience and diligently saying the same thing again and again in different ways. They needed to explain the study’s objective, how it is beneficial and how it will bring impacts a handful of times. The promise of provision of their financial diary data at the end was the most convincing one to board respondents.

- Coordinated efforts from the team- The whole team were talking to each other constantly about their encounters and possible solutions. They supported each other throughout the way including the management. In fact, one field supervisor described the relationship as more like a ‘family’.

# Recommendations

The following recommendation was forwarded from the Field Managers, Project Director and Team lead discussion for other countries’ SFD project implementation.

- Expand areas during census stage-After a decision was made about the location of the study (Addis Ababa, Debrezeit-Adama, Diredawa), getting an overview of the type of businesses in each location was the next phase. To do this, it was primarily based on observations on the ground by the field team. The field team travelled around and listed all business they saw for about 4 weeks. Then, specific areas were selected based on scores that took into account the type of businesses and the geographical spread across locations. Following this, borders were designed for each area for the field researchers to conduct the census survey. Overall, 11 field researchers conducted 1409 census surveys in three weeks. During the selection process for the intake, 160 number of surveys were dropped because they were unwilling to participate; 229 number of surveys were dropped because they belong to other sectors and 256 firms were dropped because they don’t fulfil the requirement of 2 to 23 employees. At the end, the number of valid firms found were 764. By prioritizing women owned firms and agri-processing firms a total of 558 were sampled for the intake. At the intake stage; 379 firms completed the intake survey minus those who said ‘no’ and those who refused to sign the consent forms. Now, for the diaries stage 16 firms for each respondent are already assigned that makes a total of 176 firms leaving 71 firms reserved for replacement. Thus, to have more choices down the line, it is recommended to expand the area in the census stage. The census stage should also be given more time to cover more areas. We should also be careful as assigning more areas or larger areas has a potential to be a real challenge, because it may result in the researcher having too large an area to travel which may be costly for using transport or for taking time in walking. Thus, it is important to get an area large enough to get enough choice, but small enough to not overburden Field-Researchers during diaries stage.

- Expand Key Informant Interviews-During the preparation stage, key informant interviews were conducted by the field team. A questionnaire was designed that includes questions like ‘which type of small business exist in the area’; ‘which businesses (small, medium and large) is the area known for/famous for’; ‘which small businesses are most likely to have employees/workers’; ‘which small businesses in this area are most likely to be profitable’; ‘which small businesses are more likely to be owned by women’; ‘which small businesses are more likely to be owned by youth’ and anything else they deem to be useful for the study on small businesses. A handful of experts and institutions were visited. To mention few:

- In Debrezeit- ‘Job creation follow-up expert’; ‘Business law advisor’; ‘Job creation coordinator and organizer’; Agro-processing expert

- In Diredawa- ‘Higher level expert in trade and service in Diredawa Urban Job Creation and Food Security Agency’; ‘Expert on manufacturing enterprise support programme facilitator in Diredawa Urban Job Creation and Food Security Agency’; ‘Women Enterprise Development Programme Coordinator’; ‘Planning and budget monitoring expert in Diredawa Food Security and Job Opportunity Office’.

- In Adama- ‘Coordinator of Industry and Enterprise Development at Melka Adama Kebelle’; ‘Merchant of construction material and members of micro enterprise’; ‘Trade license implementer’

- In Addis Ababa- ‘Director at Addis Ababa City Small and Medium Enterprise Organizing Office-Manufacturing and Industry Development Directorate’; ‘Team leader for enterprise capacity building and transformation at the Office of Job Creation and Enterprise’; ‘Broker and Taxi Driver’; ‘Textile, garment and leather expert’; ‘Trade Sector Expert’

However, the key informant interviews were conducted at the same time of on ground observation of the businesses in the area by the field team. We relied more on the information from the ground rather than the results of the key informant interviews. Thus, as recommendation:

(i) Key informant interviews should be done before the location observation

(ii) Key informant interviews should address organizations like “Job Creation Offices’ in all areas; ‘Trade and Investment Bureau’; ‘Urban Agriculture Directorate within Agriculture Office’ and other similar institutions.

(iii) In addition to the questions, we should ask Key Informants about where exactly different types of firms are located in the area and which areas have a higher density of businesses of the right industry and size.

- Use Navigation Apps-Some field researchers used an app called “Mapsme” that helped them to exhaustively work within each of the borders assigned to them in the census stage. It works well as a GPS navigation tool without needing an internet connection. For the field researchers, it helped them to see every road and paths to ensure coverage within a given border. This and other similar apps could be used for other countries’ census implementation.

- Disclose gifts for respondent’s participation- Gifts for respondents like the notebook should start in the intake process as it helps in convincing respondents and avoid refusal in the enrolment for the diaries

- Give Field Researcher’s opinion more weight during selection- To minimize refusals, field researcher’s opinion about respondents could be given more weight during selection for the intake. As some describe their experience, when they ask them whether they are willing to participate, they say ‘yes’ but they can see from their body language and the way they portray themselves they would not participate in the study. Add question about willingness to sign consent form in the survey- Since signing consent form has caused many refusals, it would be better if we ask in the census then in the intake about their willingness to sign a consent form.

Annex 1: Analysis of Sector in detail

the sectors in more detail

| final_sector_label | Sector_fin | n |

| A | Light | 196 |

| F | Light | 181 |

| AD | Other | 150 |

| D | Light | 112 |

| U-03 | Other | 74 |

| AE | Out | 68 |

| X | Other | 57 |

| U | Other | 54 |

| G | Agri | 51 |

| N | Agri | 50 |

| V | Other | 49 |

| DD | Light | 44 |

| EE-08 | Light | 33 |

| OTHER | Out | 30 |

| U-07 | Out | 27 |

| U-08 | Out | 27 |

| AK-01 | Out | 23 |

| AG | Out | 21 |

| S | Light | 21 |

| J-08 | Agri | 19 |

| EE-01 | Agri | 17 |

| AF | Out | 11 |

| J | Agri | 9 |

| AL | Out | 8 |

| AQ | Agri | 8 |

| AA-04 | Out | 7 |

| E | Light | 7 |

| EE-02 | Out | 7 |

| L | Out | 6 |

| M | Agri | 6 |

| NA | Out | 6 |

| T | Light | 5 |

| AA-03 | Out | 4 |

| Z | Out | 4 |

| AM | Out | 3 |

| B | Out | 3 |

| H | Agri | 3 |

| AJ | Out | 2 |

| AC | Out | 1 |

| D-07 | Out | 1 |

| EE | Out | 1 |

| K | Out | 1 |

| Q | Out | 1 |

| R | Out | 1 |

Codes for the sector