Savings groups[1] have been an astonishingly widespread and popular mechanism amongst refugees, L-IFT learned immediately from the baseline survey that we implemented in 2019 in Kiryandongo and Nakivale settlements, Uganda. One of the key findings is that saving groups (mostly using the VSLA methodology or ‘ASCA’, Accumulating Savings and Credit Association, but also ROSCA or rotating savings and credit methodology is common) appeal to refugees because formal savings mechanisms are limited.

L-IFT was surprised to find so many savings groups among refugees. We thought that the success of savings groups depends on a strong cohesion of the community and since refugees are typically recently arrived and can be expected to return to their home country, we didn’t think the temporary community of refugees would be an obvious context for prolific savings groups. What we found proved us completely wrong. So, either savings groups do not need highly cohesive communities or refugees are much more permanent and able to create a strong and cohesive community in their settlement.

This article shows the membership status of the savings group in the baseline interview (conducted in 2019); the endline interview (conducted in 2020); and the second follow-up interview (conducted in 2022). It also describes the type of savings group and attendance of meetings of the saving groups that could potentially show commitment.

# Membership Status of Saving Groups

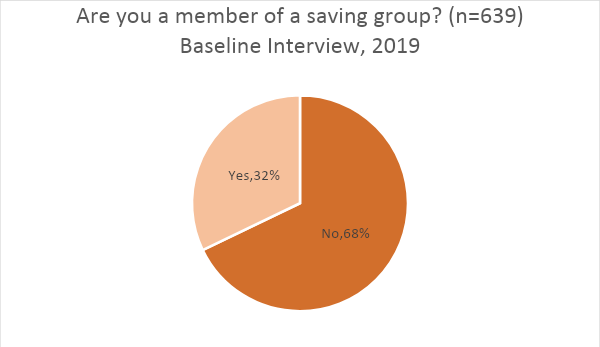

In the baseline interview, we asked them whether they were a member of a savings group. About one-third of the refugees interviewed were members.

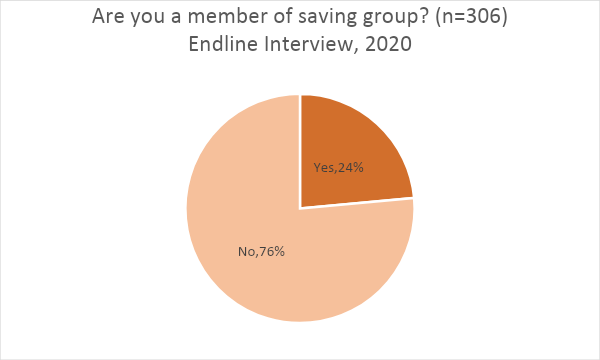

In the endline interview (in 2020), 24% (72 people) were members of at least one saving group. Out of this, 57% (n=41) were members starting from the baseline interview, and the rest, 43% (n=31) were newly joined members in the saving groups.

For those who were members in the baseline but not members after a year, we tried to look into the reasons. The following graph shows that 68% were not interviewed due to different reasons; 17% said “I don’t have this type of saving group and never had it; 8% said “it is currently inactive, but may continue later”; 6% said, “it is not active anymore” and 1% said, “it was active before baseline but not active anymore”.

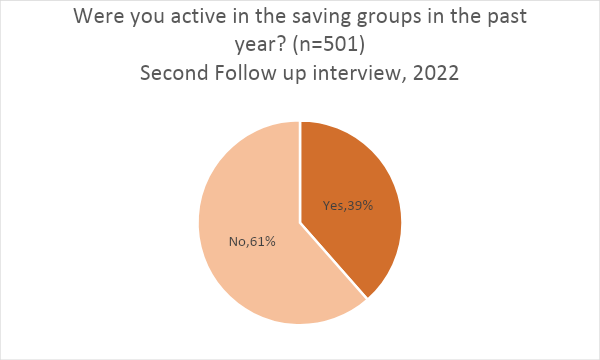

In the second follow-up interview, we asked them whether they were active in the saving groups in the past year. We roughly get the same number as the baseline, that 39% were active in some type of savings group as the below graph shows.

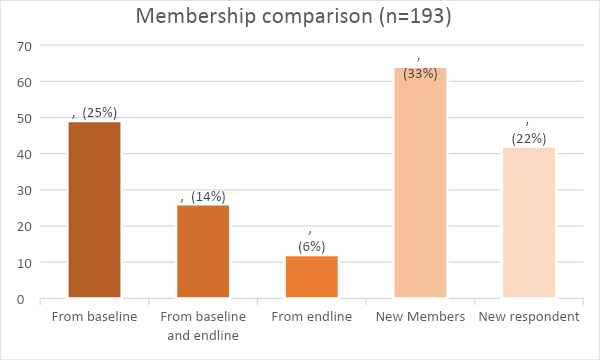

We also tried to track them individually whether they were members starting from the baseline, whether they are still members after 1 year, after 3 years, or whether they are new members. The following graph shows that 14% are consistent members in all three interviews; 25% were members in the baseline but not members after a year and said, they were members after 3 years. 33% are newly joined members in the 2022 interview.

# Type of Savings Group

We asked them about the type of savings groups in all three interviews. In the baseline, the most common type is ASCA followed by ROSCA[2].

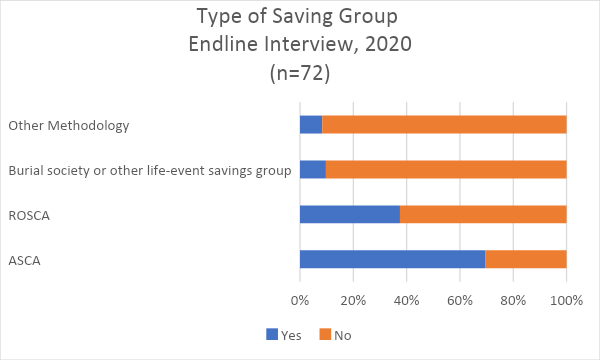

In the endline interview, similarly, ASCA is the main methodology followed by ROSCA.

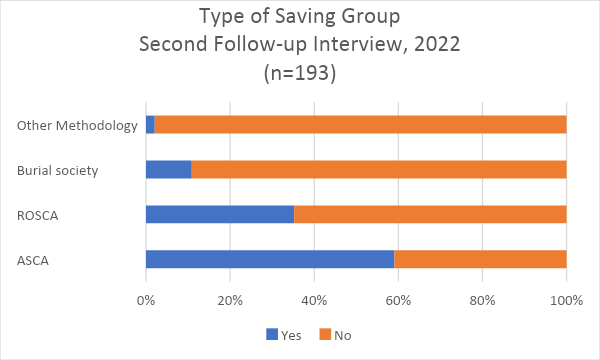

In the second follow-up interview, similarly more people (59%) were members of ASCA followed by ROSCA.

In all three interviews, ASCA seems to be the most popular methodology of savings groups among refugees.

#Attendance of Meetings in the Saving Groups

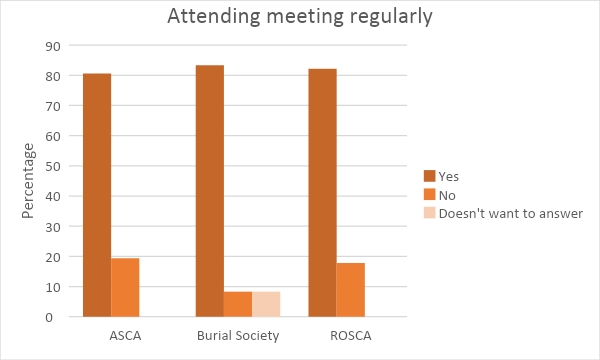

In the second follow-up interview, they were asked whether they attend meetings regularly. This was not asked in the baseline and endline interviews so we can’t compare the results. However, the response from the second follow-up interview shows that they attend meetings of the saving groups regularly. This is another indication of the commitment of the refugees to the groups.

One of the frequently heard arguments for why financial service providers do not serve refugees is that refugees are mobile. The above findings demonstrate that refugees make commitments to the savings groups in their settlements and mostly have continuous membership. From other data, we are seeing that the majority of refugees in Uganda are staying long-term and only a few are mobile. These findings confirm that refugees are an opportunity for financial service providers who could form a link with the saving groups to bring them in as new clients.

By Mahlet Alemayehu

[1] In this blog, we use the term “savings group” as a general term referring to all forms of collective savings at a smaller membership than a SACCO (Savings and Credit Cooperative Organisation). The term refers to savings groups that were formed through a programme, for instance with help of a facilitating organization like CARE, Finnish Refugee Council, or similar (international) NGOs. Most of these facilitated groups use the VSLA methodology, Village Savings and Loans Associations but they are also often named SILC, Saving, and Internal Lending Communities. The methodology of both VSLAs and SILC can be described as ASCA (accumulating Savings and Credit Association) which means that the members save weekly or monthly with the group and that the pool of savings is available for loans to the members, and these loans have to be paid back, typically with a substantial interest rate of 5 to 10% per month. The ASCA methodology usually has a “share-out” at the end of a cycle, commonly one year. There are also many spontaneous or indigenous savings groups, which emerge without support from an organization. These self-founded groups are often using the ROSCA methodology, Rotating Savings and Credit Association. In this methodology, each member contributes a fixed amount of savings and the savings of the group is combined at the meeting and allocated to one or more members, often called a ‘prize’. When all the members have received ‘the prize’ once, a new cycle is started and membership can change. The spontaneous savings groups increasingly use the ASCA methodology.

[2] Note that some respondents were a member of more than 1 group.