A crucial part of any research process is identifying respondents that fit the predetermined criteria. This is particularly complicated for a study on businesses, because in many countries there is limited information about their ‘demographic composition’, particularly if you are also considering informal, unregistered businesses. When you want to do a study on small businesses, you would ideally have access to a complete census of small firms, but that is unlikely to be available, and if available will not be up to date and often not be complete in the first place. The Small Firm Diaries project has developed a specific sampling process that starts with an area selection and a phase it calls ‘census’. It is a practical way of getting some information about the type of businesses available in certain business-dense areas and obtains some basic demographic features about these firms.

For the Small Firm Diaries Project, we needed a sample of a total of 135 small firms that have 2-20 non-household employees (or workers) and are engaged mainly in light manufacturing, agro-processing sectors or ‘other’ which includes service industries with an expected high rate of women-owned firms.

Step 1 Choosing locations: The very first decision was ‘where will the study take place’. We could include maximum three ‘locations’ – cities or towns or clusters of towns and small towns. These locations needed to be known for having light-manufacturing and agro-processing firms. Most importantly, these locations needed to be reasonably stable and safe to work in and should be manageable from a logistical point of view. It was decided to include Addis Ababa (the capital, the motor of the economy and having all types of businesses represented), the combination of Adama and Debrezeit was chosen as an area that was easy to reach, safe and expected to be active in agri-processing. We chose Diredawa as the third location since it is a sizeable town, known for entrepreneurship and distinct from the other two locations in cultural composition and with a long history.

Step 2 Describing areas: The second phase was getting an overview of which types of businesses are located in which part of the selected city/town. While we used information from publications, interviews with local and regional officials and other experts, we primarily relied on observations on the ground from our own team. As soon as the senior team of field-manager and field-supervisors were installed, they visited all parts of their assigned location. They travelled by bus, bajaj, mini-bus or walking – systematically covering all parts of the city/town. Every kilometre or so they stopped and gathered information on businesses, through observations and asking around. They ‘dropped a pin’ (recorded the GPS coordinates of the place where they were standing) and listed all the business types they saw, both those that would be eligible (businesses that produce, process, improve goods and services) as businesses that would not be considered (shops, other retail, restaurants, other hospitality). At this stage, they were not required to interview individual firms, just observe and with informal conversations get additional info about business types they may not have been able to see from the main street. This step allowed them to scan the areas for all businesses including unregistered businesses. This experience gave both the field team and project management team a preview of what businesses to expect in general, and what an area was like.

Step 3 Selecting areas: At the end of four weeks (which included several public holidays, effective work time was about two weeks), the areas and their descriptions were gathered in an excel file. We also marked each area on a map to get spatial impression where which firms were available. Then we assessed each area based on their description, through a scoring system in a spread-sheet. Areas that were primarily commercial (mostly consisting of retail shops and/or restaurants) were dropped. Each area was marked whether they had light manufacturing businesses and Agro-processing businesses. The areas were also analyzed for some 13-specific type of businesses that we expected would feature in the study (carpentry, leather, milling, food preservation…) The areas were also rated as ‘varied’ or ‘focused’. Based on that information we pre-selected some 35 areas as potential places for the study, including both varied and focused areas but prioritizing areas with many firms. Using a map of these 35, we reviewed their geographical spread across the locations. In the end we made a final selection ensuring that we would have representation of different sections of the location. Accordingly, 20 locations were selected (10 locations in Addis; 5 locations in Adama; 1 location in Mojo; and 2 (larger) locations in Diredawa and Harar).

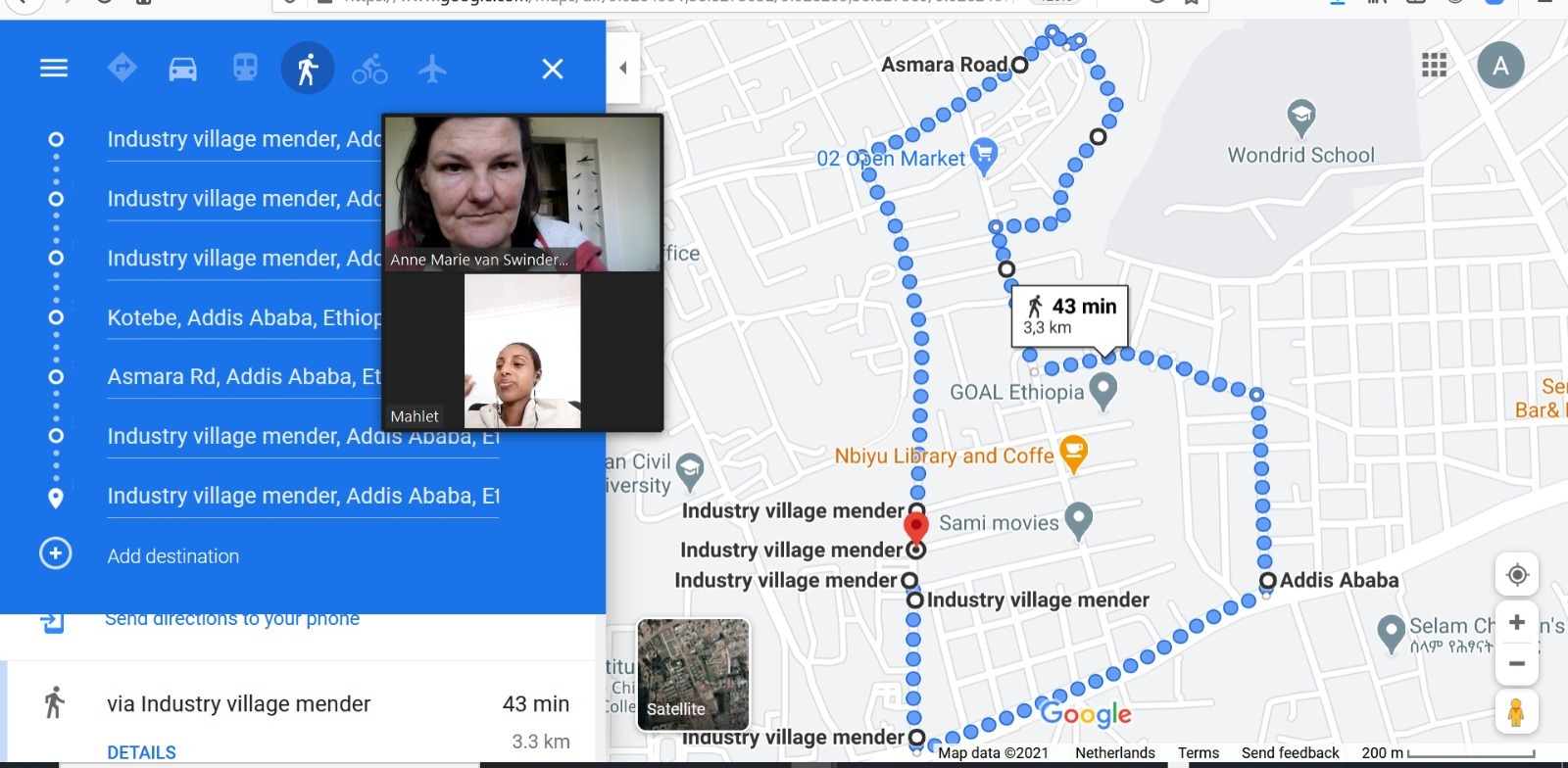

Step 4: For each of the selected areas, the Field-Manager designed borders: within the borders the census interviews would take place. See below picture for an example.

By this time the full field-team had been recruited. The Field-Manager and Field-Supervisors were joined by the Field-Researchers. The full team received an intensive training including instructions how to conduct the census survey.

Step 5: Within the limits of the borders, the field-researchers conducted the census interviews with every ‘eligible’ firm they found. There were cases where the borders proved to exclude interesting streets with many potential businesses. These borders were expanded. Some areas were dropped in the end, because they ended up having firms that did not meet our criteria e.g., only large businesses and one case where the work environment was not safe. All these decisions took place after back-and-forth discussions with the project management team. Overall, 11 field-researchers conducted 1399 surveys in three weeks.

The field team deserves a lot of credit for accomplishing such a daunting task in a short period of time despite some challenges. The most common challenge encountered by the field team was refusal to participate. The reasons were several. Lack of changes seen from previous studies conducted on their firm (a surprising number had previously participated in studies, conducted by a number of different organisations). Suspicion of being from government tax authority office and worries that findings would result in more taxes charged. Many had discomfort with disclosing financial information, it being too private and not appropriate to share. Lack of direct benefit or a payment for participation was also mentioned (the field team was not allowed to disclose that each participant would get a smart-phone and airtime/ data). The potential participants were also worried to work with an organisation that had no office in Ethiopia. Field-researchers also had challenges finding eligible firms in the assigned borders (some areas just had fewer businesses than the first visits suggested). Another widespread problem was finding owners during visits. Owners are often away from their business. At census stage, the field-researchers were allowed to record the business on the basis of information from employees, but employees were often not willing to give any information. Despite all these complications, the field-team was able to triumph over the problems and move on to the subsequent phase in a timely manner.